Make it Grow

| March 21, 2023Got a little money? Invest it wisely and turn it into a lot. You can’t afford not to

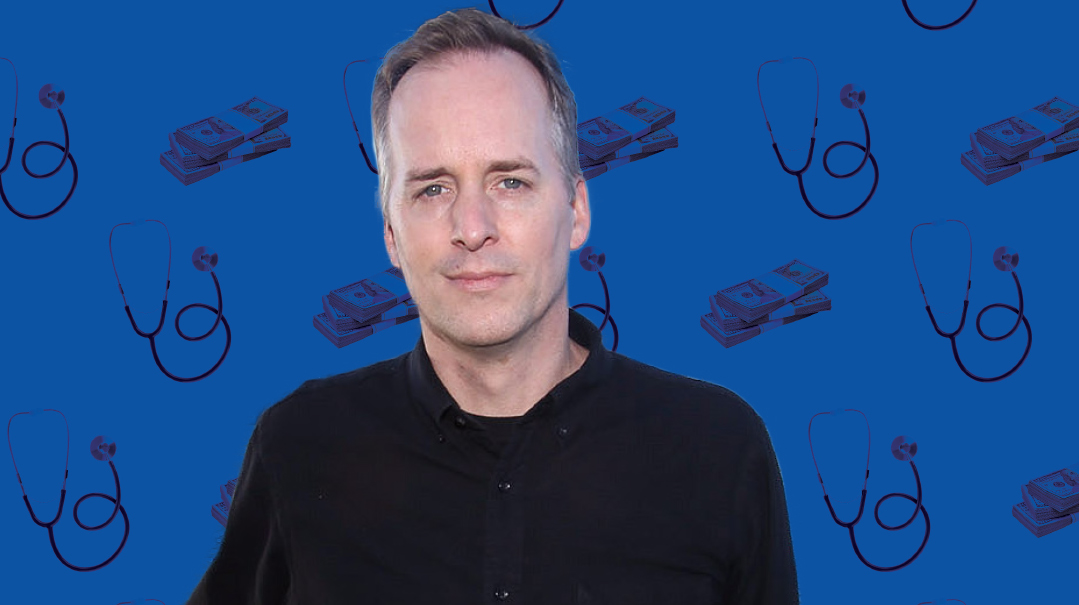

Eli Fried is an investment advisor to pensions, endowment funds, and family offices, and the founder of Gelt-Guide.com, which provides financial information, tools, and resources for the frum community. He’s passionate about educating the community about the importance of investing and dispelling some of the confusion around the process. Here he shares with Kosher Money and Mishpacha readers the Torah perspective on investments, and tips on getting started

Eli Fried has an MBA, and he’s read hundreds of books on finance, investments, economics, and business. But most of what he knows about investments he learned on the job — by investing. He started reading about the stock market as a teen, and his accrued knowledge served him well when he began working in a real estate investment firm. He learned how to find a good deal, evaluate the risk level, and determine whether or not to go for it. Today, he’s involved in the broader investment industry both as an active investor and as an advisor to others. In his own words, his job and mission are “to help people make better financial decisions.”

How does compounding work?

Compounding has famously been called a world wonder, but many people struggle to comprehend the importance of the concept. It comes down to some math.

If given a choice, which opportunity would you choose?

- Invest your money and after ten years, you get back double

- Invest your money and get only a 7.5 percent annual return

The first choice seems intuitively better, but the second is actually more profitible. People hear about steady compounding and think, “Nope, that’s not going to do it. I need more.” So they put their money in an exotic option that promises a 100 percent or 10,000 percent return — and enter a very high risk. Instead, people need to think of investing as Warren Buffet does. Compound interest is a snowball. You start with something tiny and keep rolling it around down a snowy hill. It compounds and gets huge very fast.

Interest is like that. The first roll only adds a centimeter or two, but as the initial snowball grows, the amount of interest grows every year too. The twentieth “roll” can add a full foot of cash.

To get a big snowball you need good snow and a long hill. You want your money to have as much time to roll as possible, because the first few rolls at the beginning are not nearly as valuable as later on, when the snowball gains momentum and reaches the bottom of the hill.

People are amazed when they look at the numbers. A small $1,000 investment in your twenties becomes $30,000 or even $50,000 when you’re ready to retire; 50X with minimal effort or risk.

How can you avoid falling prey to scams and bad investments?

Fraud happens when you trust someone. The likelihood you’ll trust a respected community member — even if they actually offer sketchy advice — is high. Misapplied trust can lead to risks you’re not prepared for.

There’s actually a phenomenon called affinity fraud, which describes when people take advantage of community ties or demographics to scam someone out of their money. Fortunately, it’s not so common in our community, though it does occur. What’s more likely is that people will take excessive risks because they trust someone else’s opinion more than they should.

Most of this can be avoided when you follow common sense, as outlined in various Torah tips.

- Kabdeihu v’chashdeihu — Respect people, but don’t give blind trust. Getting a second opinion should be the basic protocol.

- Get everything in writing; the Gemara talks about this concept extensively. And have someone you trust review it.

- Diversify. When Rav Moshe Feinstein would hear stories of frum people who got completely wiped out financially, he would question why they hadn’t diversified. It’s an investment principle straight out of the Torah. If you don’t have enough to diversify, you don’t belong in the deal. Start off investing in mutual funds, which diversify for you, until you have enough to enter a few deals — never only one.

Oops! We could not locate your form.